Token Launch Mechanics

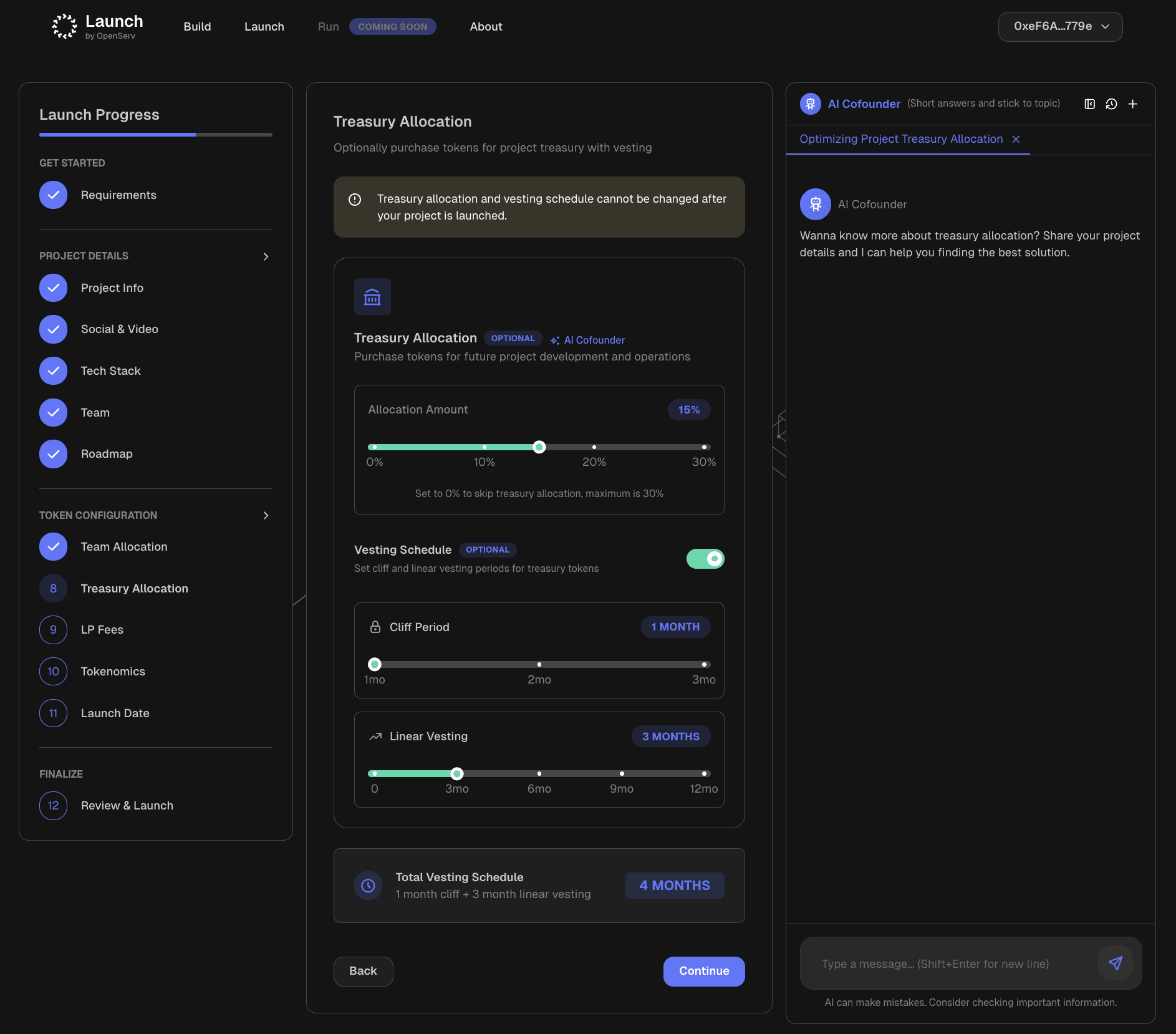

1. Project Initialization

During initialization, founders configure all immutable parameters, including:

- Project identity and public metadata

- Team allocation and vesting schedule

- Optional treasury pre-buy

- Liquidity pool fee tier

- Launch timing

An AI Cofounder supports this process by assisting with token design, positioning, and launch readiness.

Once confirmed, a public project page is published displaying:

- Token supply and distribution

- Team and vesting details

- Product, roadmap, and technical information

2. Bonding Curve - On-Chain Price Discovery

At activation, the token is deployed into a bonding curve that governs initial distribution and pricing.

Core properties:

- No presales or gated allocations

- Identical access rules for all participants

- Deterministic, on-chain pricing

To protect distribution integrity, the system applies a time-decaying buy-side tax:

- Starts at 99%

- Decreases by 1% per minute

- Stabilizes at 2% after ~98 minutes

This mechanism prioritizes organic participation and mitigates bot-driven manipulation during the opening phase.

All taxes collected during this period will be placed in the project's treasury.

Trading fees during this period are allocated automatically to:

- The project creator (67%)

- Protocol (33%)

3. DEX LP Migration

Once the bonding curve accumulates 10 ETH in liquidity, the system executes an automatic migration to OpenServ’s launchpad partner, Aerodrome on Base and Meteora on Solana.

At this point:

- Liquidity is deployed to DEX

- LP tokens are locked for 10 years

- Founders begin earning LP fee revenue according to selected fee tier

- Trading continues in a standard AMM environment

Crypto Startup Tokenization Platform

The Crypto Startup Tokenization Platform is the launch and capitalization layer within OpenServ, enabling founders and teams to tokenize crypto-native startups in a structured and transparent manner.

Token Distribution

All projects launched via SERV Launch use a fixed total supply of 1,000,000,000 tokens, distributed across standardized categories to ensure consistency, transparency, and fair market participation.