Crypto Startup Tokenization Platform

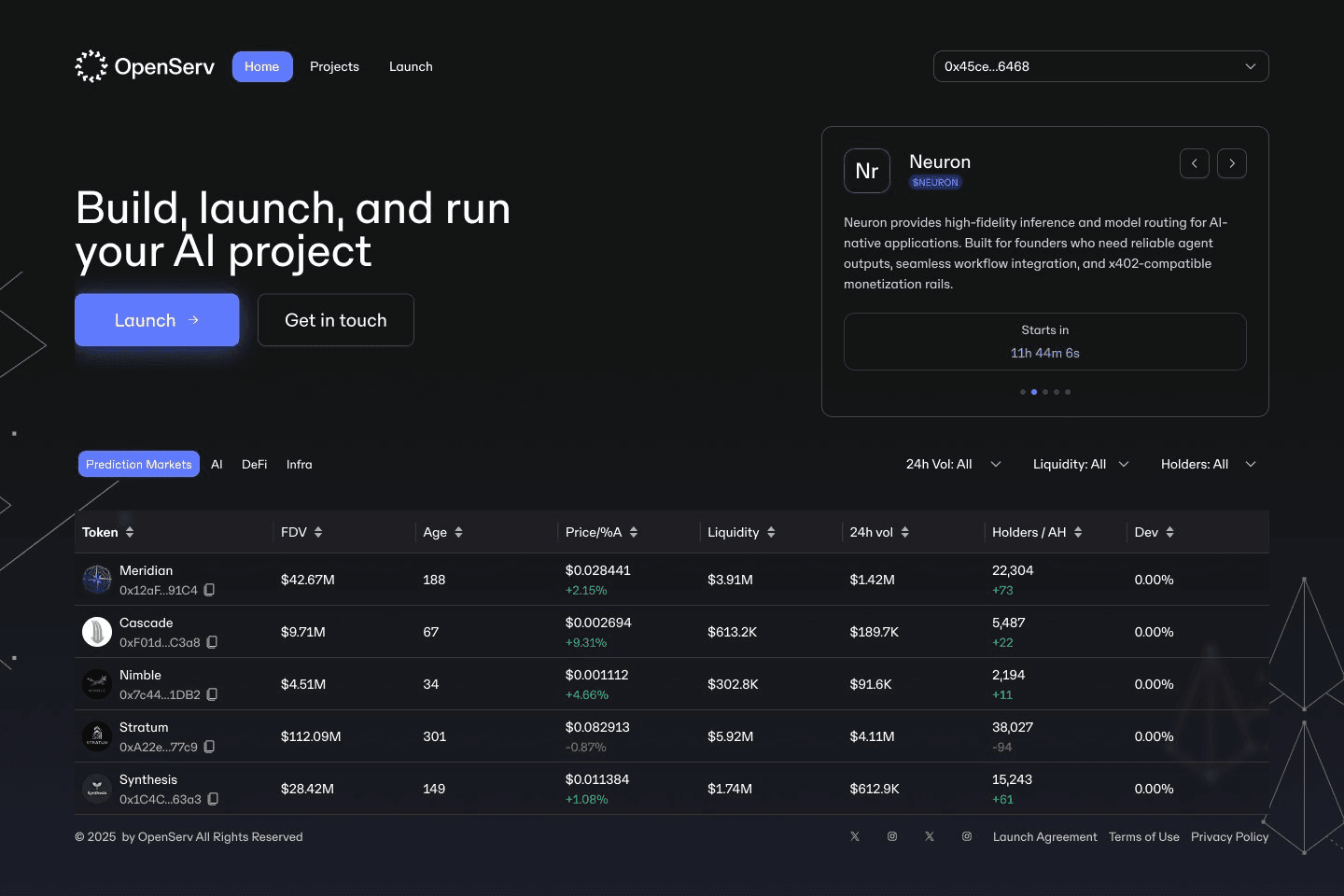

The Crypto Startup Tokenization Platform is the launch and capitalization layer within OpenServ, enabling founders and teams to tokenize crypto-native startups in a structured and transparent manner.

What it is

It is the point at which startups built on the OpenServ Build stack are introduced on-chain, converting working products, AI agents, and early traction into live, investable networks. Tokenization occurs at a defined stage of the startup journey, anchored to real teams, real software, and clear execution plans.

The platform allows founders to bootstrap:

-

Users and community

-

Attention and distribution

-

Early-stage capital

All launches follow standardized, fair tokenomics designed to favor public participants over insiders, with transparent allocations and enforced vesting.

For investors, the platform provides access to verifiable teams and AI-native startups at their earliest stages, under consistent structures that make projects comparable and legible.

Post-launch, teams can operate and scale using OpenServ’s Run automations for marketing, sales, growth, and operations—allowing small teams to execute at the level of much larger organizations.

The result is a tokenization layer that connects product execution, public ownership, and long-term operation within a single startup lifecycle.

Why we've built it

Crypto capital formation has largely evolved around token launches that are decoupled from real products, teams, and execution, leaving investors to speculate on narratives rather than verifiable progress.

At the same time, access to early-stage, high-quality startups—particularly in AI—has remained largely limited to venture capital firms and private networks, with public participants entering only after meaningful upside has already been captured.

We built the Crypto Startup Tokenization Platform to change this dynamic.

By anchoring launches to startups that are built and operated using OpenServ’s AI stack, the platform creates a pipeline of real, AI-native businesses rather than isolated token events. Projects launch with working software, identifiable teams, and the infrastructure required to continue operating post-launch.

This allows investors to participate in early-stage AI startups with greater transparency and standardized, fair tokenomics that favor public participants and reduce information asymmetry.

The result is a more equitable and transparent way to connect investible startups with global capital—bringing early-stage opportunities to the open market that have traditionally been inaccessible.